🏦 Personal Finance Basics: How to Create a Monthly Budget from Zero

Imagine this:

It’s the end of the month. Your paycheck is gone. You scroll through your bank app and wonder “Where did all my money go?”

Don’t worry! we’ve all been there. The truth is, most people don’t start with savings, and almost no one begins with a “perfect budget.” But that’s exactly why starting now leven from zero is powerful.

This is your step-by-step guide to creating your very first monthly budget simple, real, and built for beginners.

1. Get Honest About Where You Are

Before you can control your money, you need to see it clearly.

Sit down with a notebook or open your phone’s notes app. Write down:

• How much money you earn

• What you spend it on

• Any debts you have

Don’t judge yourself. This step isn’t about guilt. it’s about clarity.

Think of it like stepping on a scale before starting a fitness plan you can’t improve what you don’t measure

2. Group Your Spending Into Categories

Now that you know where your money goes, it’s time to organize it.

Here’s a simple way:

• Needs (50%) – Rent, food, transportation

• Wants (30%) – Eating out, entertainment

• Savings/Debt (20%) – Savings, paying loans

Even if you can’t save 20% yet, start with 5%. The habit matters more than the amount.

“You don’t have to make big money to make smart moves.”

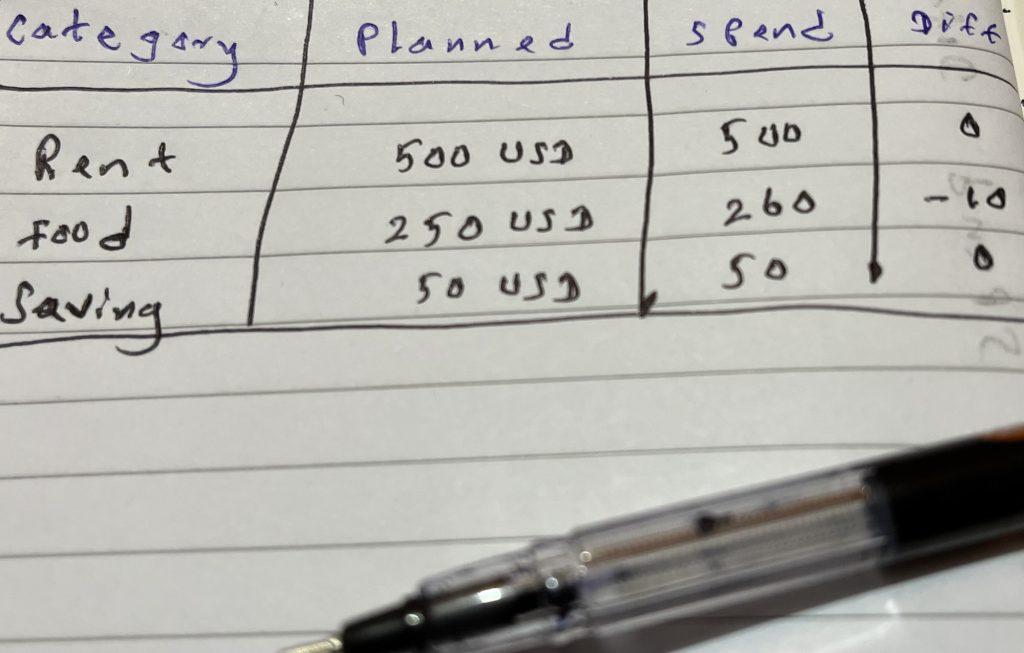

3. Create Your Monthly Plan

Now, let’s build your first real budget.

Open Google Sheets or grab a notebook and list:

You’ll see where the leaks are, and where you can adjust next month.

4. Automate What You Can

One of the easiest ways to stay consistent is to automate your money.

Set up automatic transfers:

• Move a small amount ($20–$50) into your savings right after payday

• Schedule bill payments to avoid late fees

That way, your savings grow without you even thinking about it.

5. Review Weekly — Don’t Wait Till Month End

Most people wait until the month ends to check their spending – that’s too late.

Instead, every Sunday night, spend 5 minutes reviewing your money.

Ask yourself:

• Did I overspend anywhere?

• What can I do differently next week?

Small weekly check-ins prevent big monthly surprises

6. Be Kind to Yourself

Budgeting isn’t about perfection. Some months you’ll overspend, and that’s okay.

The goal is progress, not punishment. Every time you track, save, or plan. You’re building control, peace, and a future that’s truly yours.

Remember: “It’s not about how much you make — it’s about how you manage what you have.”

Final Thoughts

Starting from zero isn’t a weakness. It’s a beginning.

Each month you plan, track, and adjust, your money starts working for you, not against you.

Stay patient. Celebrate small wins. Your future self will thank you. 💛